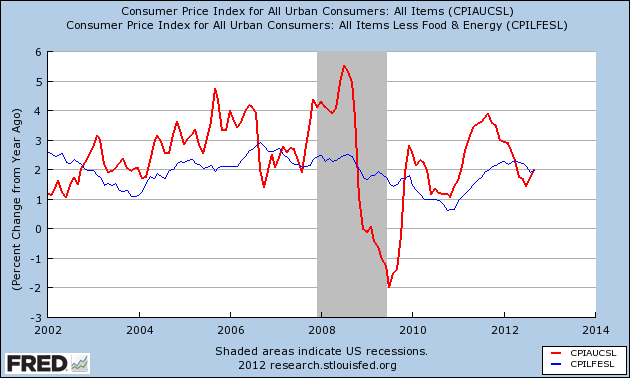

Here is a graph of the full seasonally corrected CPI vs the core CPI (consumer inflation excluding food and energy). In the short run they diverge, for example energy prices pushed the overall index up in 2008 and then down in 2009, without having much impact on “core” inflation. Over the longer haul they correlate closely (go to FRED if you want to see a longer period graphed). Furthermore, the full CPI is much less volatile and thus harder to interpret — is inflation trending up or is it just a short-term blip?

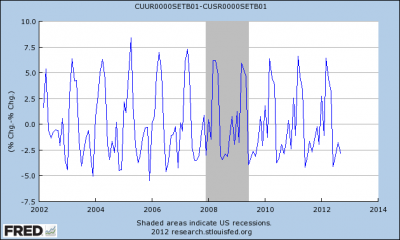

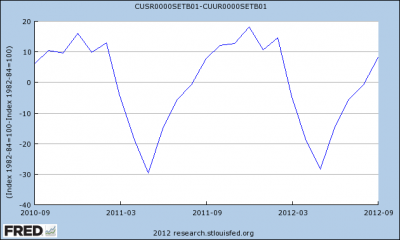

Here is a comparison of seasonal and non-seasonal series, and the difference between the two that clarifies the nature of the seasonal correction. For this graph I used gasoline prices, since that was what we touched upon in class. The bottom one makes the pattern clearer, prices peak in December, fall sharply in March-April-May, and then from June through the winter.