In this post I look at a few articles whose authors have different viewpoints about the strength of the US economy’s recovery and how recoveries should be examined. In one corner there are co-authors Carmen Reinhart and Kenneth Rogoff, and in the other corner there are co-authors Bordo & Haubrich supported by Stanford economist John Taylor.

In Rogoff and Reinhart’s most recent article, they examine the US recovery in three different ways. The three figures below compare the current recovery to historical U.S. systemic financial crises comparing real GDP per-capita, the change in unemployment rates between historical crises, and lastly they compare the US recovery to the recoveries of foreign countries following the financial crisis.

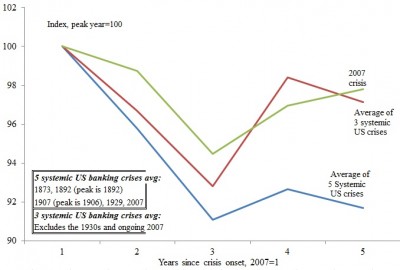

Figure one depicts real per capita GDP in the aftermath of systemic banking crises in the US. As you can see, the initial decline in per capita GDP is smaller for the recent crises than in the earlier crises. Five years into the recovery, the current level of per capita GDP relative to the baseline is higher than both of the 3-crises and 5-crises averages.

In Figure two the authors look at the unemployment rate change from the beginning of the crisis. In a bit we will see that Bordo and Haubrich strongly suggest that the US rapidly recovers from systemic financial crises, but according to this data this is simply not true.

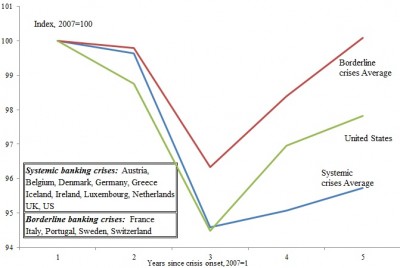

Lastly, Rogoff and Reinhart take a look at cross-country real GDP per capita from 2007 to 2011. It is important to note that they distinguish between countries that experienced true systemic banking crises and those countries having milder problems in the financial sector (The authors note that this does not preclude form having other series financial issues, such a fiscal problem). Rogoff and Reinhart point out that the US per capita GDP contraction beginning in 2007 shows a similar initial decline as the European countries who were undergoing systemic financial crises, but the US experienced a faster recovery.

In their work, Michael Bordo and Joseph Haubrich examine the financial crisis in the scope of all US recessions and subsequent recoveries from 1880 onward. They concluded that the recovery is weak compared to recoveries from serious recessions in the past, including those associated with financial crises. In their analysis they show that steep expansions tend to follow deep contractions and furthermore that recessions accompanied by financial crises bounce back even faster than recessions lacking a financial crisis. This is the pattern in US economic history until the most recent financial crisis.

Bordo and Haubrich’s main point is that the United State’s economy is ‘different’ in the way it recovers quickly from recessions involving a financial crisis. They contend that it is illogical to compare the US recoveries to those of other countries because of the differing institutions, financial structures, and economic policies. While Reinhart and Rogoff focus on the level of real per capita GDP from the peak before the crisis to the point in the recovery at which the earlier peak is reached, Bordo and Haubrich examine the “bounce back” or the pace of the recovery from the low point of the business cycle.

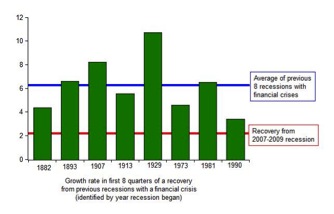

John Taylor supports Bordo and Haubrich’s work by stating that because Reinhart and Rogoff have a narrower definition of a financial crisis, they ignored cases of regular business cycles. Taylor also provides the graph below depicting the growth rate in the first eight quarters of a recovery from recessions involving financial crises.

As you can see in the chart, the pace of recovery from the 2007-2009 recession is well below the average of previous recessions. Taylor further criticizes Reinhart and Rogoff by stating that mixing recessions with recoveries blurs the classic economic distinction. Because they do not only look at recoveries, their empirical analysis does not disprove that this current recovery is weak.

In my opinion, I favor the approach of Taylor, Bordo & Haubrich. While it is impossible to determine which methodology is more correct, I agree with the notion that looking at growth rates during a recovery is empirically more sound than examining unemployment data from very old crises as well as attempting to compare the US with other countries. I believe that the last graph presented by Rogoff and Reinhart is almost irrelevant. Attempting to differentiate between the crises European countries faced seems too complex, and frankly they do not shed light on how they made such distinctions.

This Time is Different, Again? The United States Five Years after the Onset of Subprime Carmen Reinhart Kenneth Rogoff Harvard University October 14 2012

http://www.voxeu.org/article/time-different-again-us-five-years-after-onset-subprime-0

Weak Recovery Denial John Taylor October 17

http://www.johnbtaylorsblog.blogspot.co.uk/2012/10/weak-recovery-denial.html

Deep Recessions, Fast Recoveries, and Financial Crises: Evidence from the American Record Michael Bordo Joseph Haubrich Working Paper 12-14 June 2012 Federal Reserve Bank of Cleveland

http://www.clevelandfed.org/research/workpaper/2012/wp1214.pdf

One Comment

The work of Reinhardt and Rogoff is widely cited. Debt vigilantes use their “crises are more frequent over the 90% debt/GDP threshold.” Others in the Romney camp have misused their work to claim the current recovery is abnormally slow. But this article is explicit on that front. More later, but their work is careful and thoughtful, and they respond to critiques and provide nuanced treatment of the data. They do not have an axe to grind, or if they do, they don’t let it dominate to where they ignore data.

Comments are closed.