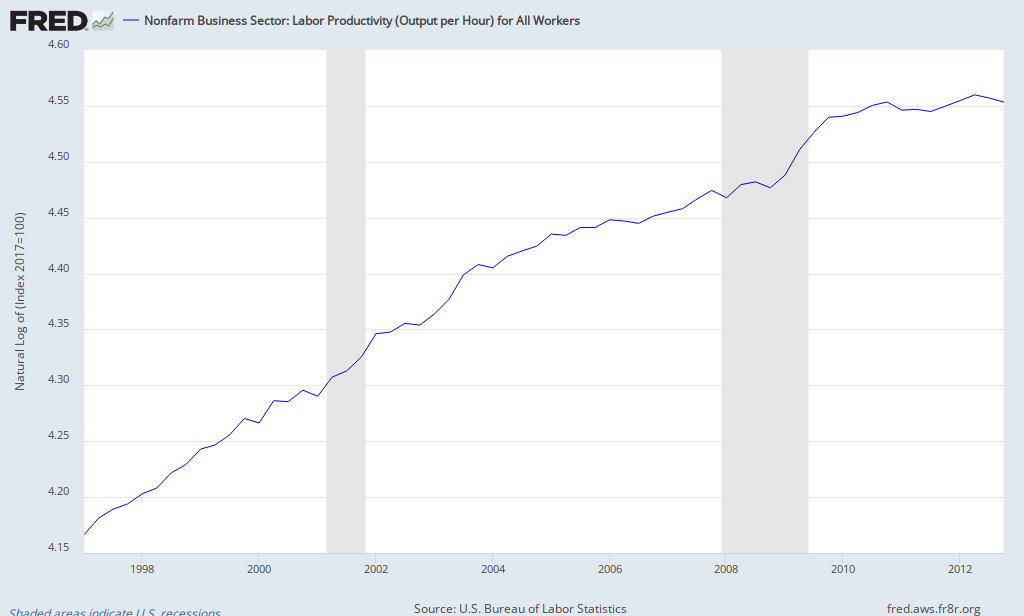

The Labor Department recently reported a disappointing US worker productivity contraction of an annual percent of 2 percent in the fourth quarter of 2012. In the same timeframe, the economy declined at an annual rate of .1 percent, potentially attributed to defense cuts and slower restocking. The departure from positive numbers in the third quarter may also be due to expectations of the potential implications of the sustained fiscal cliff issue. Some economists are not surprised with the weak trend in productivity from the last two years as they see it as part of the cycle of recovery from a recession. For a period immediately after a recession, productivity will appear to rise because a smaller labor force must meet increasing demand. As demand rises, companies must hire more workers if they want to compete in the marketplace. (The full article.)

According to Timothy Aeppel, “Nearly all the world’s advanced economies are grappling with a productivity problem” starting from a decade ago. The rate of growth in multifactor productivity started to decline, in the US from annual growth of 0.7% in the 1990s to 0.39% in the 2000s. There is no consensus on the exact cause of the slowdown. Some says it is the anticipation of the recession but it does not explain why the length of time is so long. Japan grappled with this same problem from the late 1980s through the 1990s, known as the “Lost Decade.” One of the most famous papers on this topic concludes that it was a business cycle problem, that of low growth in factors of productivity. Is this worldwide problem a reflection of the same issue?

Solow’s growth model shows that economic growth can be sustained if there is an increase in capital accumulation and/or population growth. However, technological progress is essential for continuous long-term growth by shifting the production function up. Robert Gordon disagrees with the theory that the 2% productivity increases of the post-WWII era will persist. As he argues, the United States economy grew due to the lingering effects of three industrial revolutions. Low productivity in the last decade seems to support Gordon’s argument, However the recession of this period makes it difficult to form conclusive remarks or to develop an experimental design. The changes to spending and behavior prior to and after the recession may be significant factors to the problem. However, in macroeconomics, it is difficult to analyze the recession because there is a shortage of data (relatively few recessions throughout history, and lack of consistent measurements) and there exists a time series issue. This decade also speaks to Solow’s argument because the technology of the last decade may not be so substantial as to shift the production function by much. Slow economic growth may only be a reflection of movement along the low marginal increase portion of the production function.

Solow’s growth model shows that economic growth can be sustained if there is an increase in capital accumulation and/or population growth. However, technological progress is essential for continuous long-term growth by shifting the production function up. Robert Gordon disagrees with the theory that the 2% productivity increases of the post-WWII era will persist. As he argues, the United States economy grew due to the lingering effects of three industrial revolutions. Low productivity in the last decade seems to support Gordon’s argument, However the recession of this period makes it difficult to form conclusive remarks or to develop an experimental design. The changes to spending and behavior prior to and after the recession may be significant factors to the problem. However, in macroeconomics, it is difficult to analyze the recession because there is a shortage of data (relatively few recessions throughout history, and lack of consistent measurements) and there exists a time series issue. This decade also speaks to Solow’s argument because the technology of the last decade may not be so substantial as to shift the production function by much. Slow economic growth may only be a reflection of movement along the low marginal increase portion of the production function.

Singapore will pursue an economic restructuring in the New Year with plans to increase productivity through strategies such as enhancement of “productivity grants”, allow businesses easier access to credit, and reduction of transport costs etc. It will be interesting to see if these plans will succeed as it relates directly to changes to capital accumulation and innovation.

Link to US Bureau of Labor Statistics Productivity and Costs release.

3 Comments

The strongest argument of those countering Gordon is that the productivity implications of major innovations typically take decades to be realized. They cite the slow diffusion of the telephone, the initial battles between gas and electric lighting (hampered by Thomas Edison’s initial use of direct current), and lag between the first railroad and the development of a nationwide network. An example I might use are container ships, with the first one built in 1951 and the current container design fixed (patented) in 1955. It revolutionized trade — if you can use “revolution” for something that is achieved in slow increments, since it took a while to standardize container sizes, domestic transport regulation (a “common carrier” mandate) affected the ability to develop container-only infrastructure, and to offer container-specific rates. Volumes surged in the late 1990s / early 2000s, so it took 50 years…

It would be interesting to see how this was affected by the negotiations and new fiscal policies associated with the sequester. While we struggle to come to an agreement on the new plan, the sequester budget cuts that are already in place are harming our economy. Looking at productivity broadly, I think we need to place more emphasis on schooling and education. I also think we should invest more intelligently in these fields. Instead of pouring tons of money into the education of those with learning abilities or trouble keeping up, we should also be concerned with improving the education of students who are already well ahead of the rest of the class. I do not mean to sound insensitive, but the students who are already learning at a faster pace have the propensity to benefit more from the same amount of money. Perhaps I can not fully apply this economic idea without sounding insensitive and barbaric, but more intelligent students who are already learning at a faster pace have a comparative advantage in learning when compared to students with extreme disabilities or who struggle to keep up with the rest of the class. Again, I am not suggesting that we stop spending money entirely on students with disabilities or who learn at a slower rate, I am just suggesting that perhaps we should also focus our efforts on creating more programs for more gifted students.

I agree with much of what you said Maggie, but it is important to note the potential downfalls of ignoring the less fortunate. It is the less fortunate who will be receiving benefits from the government, and ignoring them will entail a much higher social cost. Furthermore, accelerating gifted students would serve to create an even wider educational achievement gap that could lead to a more divided country. A divided country is the last thing our economy needs.

Without going on a political rant, I feel like the current administration is constantly dividing the country with his talks of the “1%,” his refusal to discourage the many protests on Wall Street, and his “them vs us” campaign in the 2012 election. While it certainly got him votes, it was a despicable show of politics and lacked reason. For him to contend that successful Americans, regardless of their background and how they got there, aren’t paying their fair share as a way of separating those who have much from those who have little is unfair to many who embodied the American spirit and worked hard to become successful in whatever it is that they do. I’m not saying that the U.S. has high tax rates relative to other developed countries (I believe we are among the lowest), and maybe dividing the country to some extent is unavoidable, but the way the current administration has divided the country is embarrassing to me.

Comments are closed.