The other day, I made a blog post about the Greek debt crisis. After reading Professor Smitka’s comment, I wondered how effective/ineffective the IMF’s austerity policy has been in European debtor countries like Greece. Gechert et al. attempt to answer this question by estimating changes in fiscal multiplier during an economic downturn in their paper “Fiscal multipliers in downturns and the effects of Eurozone consolidation”.

For those who are not familiar with the term ‘fiscal multiplier’, it is the ‘ratio of a change in national income to the change in government spending that causes it’. In other words, it measures how GDP responds to a specific fiscal instrument such as taxes and government transfer.

The values of multiplier are drawn from standardized fiscal impulses which allow for comparable input-output responses. Gechert et al. use a meta-regression analysis of multipliers collected from a set of empirical reduced form models conducted by Gechert and Rannenberg (2014). This database incorporates 98 previous studies published between 1992 to 2013, thus providing a sample of 1882 observations of multiplier values. Lastly, they control for the economic regime (as in good/normal/bad condition of economy) associated with a given fiscal multiplier estimate in order to observe how multipliers vary in different economic circumstances.

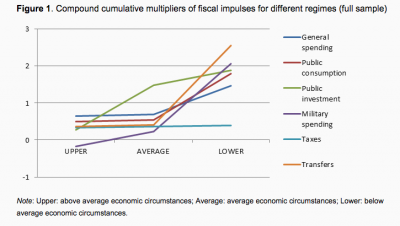

Their regression results show that multipliers of general government spending vary between 0.4 and 0.7 in normal economic circumstances or booms. In crisis situations, however, the multipliers become larger, exceeding the average range by 0.6 to 0.8. Furthermore, some instruments increase fiscal multipliers by much more than others do during a recession. As the graph below depicts, fiscal transfers (which is the second least effective instrument after the military spending in average/ above average economic circumstances) yields the steepest increase in multipliers during below average economic circumstances. On the other hand, the tax multipliers become much lower in the downturn – the opposite result compared to spending multipliers. This finding illustrates that that tax reliefs are less efficient at countering a recession.

What does this mean for countries like Greece mired in the Eurozone Crisis? When Gechert et al. apply their multiplier estimates to the cumulative changes of the fiscal instruments in the Eurozone, they estimate that the fiscal consolidation (i.e. austerity policy) reduced GDP by 4.3% in 2011, 6.4% in 2012, and finally 7.7% in 2013. The authors also find that the biggest contribution to this decline by far comes from significant transfer cuts, (which is consistent with the graph above).

So, Gechert et al. make it very clear that austerity policy might be doing more harm than good. Is fiscal sustainability really that much worthy of a goal to overlook more than 7% of GDP contraction?

One Comment

What is the goal of policy? To be “proper” or to contribute to the commonweal, including above all jobs and secondarily macroeconomic stability? It is quite possible that austerity in fact will not contribute in the short run to lower deficits, either, as years of extended slow growth can add more to debt than a (successful) stimulus program of a couple year’s duration.

The background (or back story) to this paper is that a group of economists claim that austerity has no negative macroeconomic implications, while debt is holding down growth today. Given record low interest rates the latter claim is specious, but if you have faith that your model is “the” way an economy works, then you don’t let real world stand in the way. That begs the question of how to bring empirical data to macro models, a topic for today’s class on macroeconometrics.

Comments are closed.