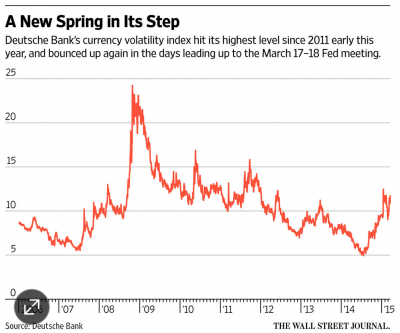

Central banks have recently created a great deal of volatility in foreign exchange markets. The Fed reiterated its message on Wednesday that it will not raise interest rates anytime soon, which caused a big slump in the dollar. The euro, as a result, surged more than 4% to the dollar, the largest increase the euro has seen in about 15 years. The euro and dollar are the world’s most heavily exchanged currencies and as a result, many in the financial sector are curious to see what the future holds. Many are looking back to when the Swiss central bank abandoned its policy of fixing the franc to the euro. This trend has brought up additional concerns, mainly concerning the regulations brought in after the financial crisis that have hindered liquidity in markets by preventing banks from making risky bets. Volatility indexes are at their highest levels since around 2011. However, others see this as return to normalcy with higher levels of volatility. The dollar is currently experiencing its fastest pace ascent in 40 years, so there is currently risk for a pullback according to many.

http://www.wsj.com/articles/forex-market-erupts-on-central-bank-moves-1426773181?mod=WSJ_hp_LEFTTopStories&cb=logged0.897193348268047

4 Comments

The Dow Jones Industrial Average and other major stock indexes spiked as soon as the Fed released their statement Wednesday. Investors also dove into longer yield bonds. There was definitely an interesting response by financial markets to the Fed removing “patient.”

We should however look at all this a few days out, there is a lot of money that shifts on short-term speculative plays. However, foreign exchange markets do seem to follow a random walk in the short run, so perhaps your snapshot is what we should look at.

Currently the Euro is the lowest its been compared to the dollar in 12 years. And Europe still has a lot to sort out. As per Moore it’s nice to see markets responding favorably to the Fed’s announcement.

It is interesting to note that a lot of analysts are forecasting the dollar to decline in value again. Many have linked the dollar’s strength with pushing the price of oil down — is it wise to predict that oil prices will rebound as soon as the dollar depreciates?

Comments are closed.