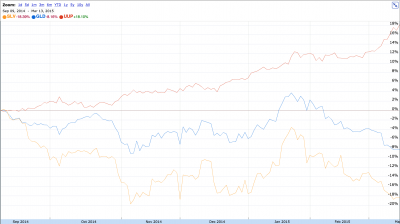

Precious metal prices have struggled to combat the recent appreciative momentum of the dollar. The chart below shows changes in gold (Blue) and silver (yellow…or “gold”) prices along side changes in the relative value of the dollar against a basket of global currencies. Silver clearly has struggled more than gold, though other factors might be at play.

Both metals serve as havens for people who might lose trust in their currency. However, so does the dollar. Currently, we have a world filled with countries trying to devalue their currency, especially in Asia. Silver and gold charts look far less drastic when they are priced in currencies other than the dollar. The question becomes: could global currency wars ever boost precious metal demand enough to see a rise in the dollar based price? Or, would such currency depreciations boost dollar demand enough to render the precious metals jump meaningless, in dollar terms?

http://money.cnn.com/2015/03/12/investing/gold-rebound-doubleline-gundlach/index.html?iid=SF_INV_River

2 Comments

There is another very important component to this story: what are real returns elsewhere? Holding gold is costly in out-of-pocket terms: if you hold it directly you have the costs of physical delivery and of a safety deposit box — if you hold it indirectly, you face charges, implicit or explicit, for such services. Meanwhile, you earn no dividend or interest, so there’s the opportunity cost of having your assets tied up in a purely speculative investment. If/when growth around the world is enough to lift real returns on financial assets, then the prices of commodities will fall. A lot. Now many commodities (petroleum) do have real value for industrial and other uses. Gold does not, it’s 100% speculation.

Could the struggle of the precious metal prices to keep up have to do with the issue that gold is based on speculation? Gold does seem to do better during both inflation and deflation, when it is more likely people lose trust in their currency yet it is also a more unpredictable market.

The suggestion of investing in gold mining stocks or popular exchange-traded funds like the GLD or GDX is an interesting one to combat the costs of holding it directly. I would be interested to know more about the charges associated with investing in these funds especially in terms of the dollar compared to other currencies.

Comments are closed.