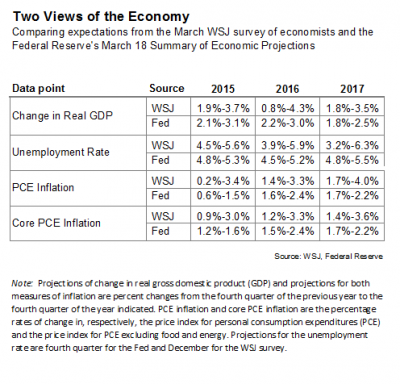

The Federal Reserve released its latest set of economic forecasts on Wednesday. While much of the news has revolved around removing the word “patient,” inflation remains a major talking point. According to the Fed’s forecasts, real GDP could grow between 2.1% and 3.1% in 2015 and 2.2% and 3.0% in 2016. The unemployment outlook suggests the unemployment rate could be between 4.8% and 5.3% by the end of 2015 and 4.5% and 5.2% by the end of 2016. The Fed’s growth and unemployment forecasts fall in the middle of private economists’ predictions. In terms of inflation, both the Fed and private economists believe the end of falling energy prices means inflation should edge higher over the next two years. Inflation was measured by the price index personal consumption expenditures. The Fed, though, expects a slower pick up in inflation than private economists. The highest Fed forecast call for inflation to 1.5%, while the highest private forecasts expects inflation to hit 3.4%. Also, no Fed forecaster expected inflation to hit the 2% target until 2016. Which story do you believe? The Fed’s or the private outlook?

Source: http://blogs.wsj.com/economics/2015/03/18/fed-officials-see-slower-inflation-pickup-than-private-economists-do/

2 Comments

I don’t listen to a forecaster unless I know what model they are using. Some apparently still depend on the wet finger model: spit on it, hold it up and see which way the forecasts of your peers are going and then (in some cases) go a bit further. The Fed I understand.

How valuable can the “WSJ survey” of economists be as compared to the Fed. The spreads for the Fed are invariably narrower, because it’s likely an official pronouncement. With the survey of course when asking more people you’re like to get a wider range of ideas. I’d like to see how the Fed reached these estimates and see how well their methodology has worked in the past.

Comments are closed.