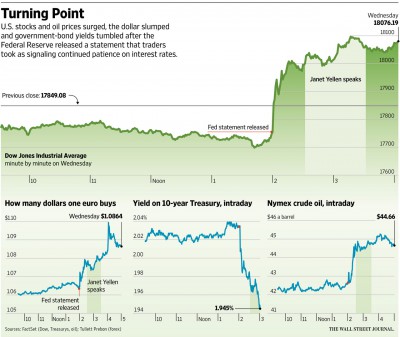

As expected, the Fed removed the word “patient” from their statement on Wednesday and financial markets responded. The Dow Jones Industrial Average rose roughly 200 points (1.3%) in the seconds after the Fed released their statement. Other indexes also responded: the S&P 500 increased 1.2%, the Nasdaq increased 0.9%, and the Russell 2000 increased 0.8%. Fed Funds futures suggest investors see a 23% likelihood of rates increasing in June, compared to the 40% likelihood before the Fed’s statement. Odds for a September increase fell from 111% to 80% according to Fed Funds futures. There has also been a noticeable effect on the bond market. The yield on 2-year notes fell from 0.669% to 0.560%, and investors went into longer-term U.S. bonds. The 10-year note’s yield fell below 2% to 1.945%. On the other hand, the dollar suffered experiencing its biggest one-day decline against the Euro since March 2009. The dollars intraday fall comes in context of the dollar’s 27% gain against the euro in the past year. Wednesday was an exciting day for the markets, but what do you think about the effects of the Fed’s statement?

Source: http://www.wsj.com/articles/investors-celebrate-gentler-tone-from-fed-officials-1426720774?mod=WSJ_hp_LEFTWhatsNewsCollection

3 Comments

How about interest rates? That is where the causal relationship ought to be strongest!

Because the Fed controls the value of the dollar it makes sense that the dollar should gain against the Euro. As people see interest rates about to rise in the US, investment will be comparatively more attractive there than in Europe.

I think it also helps that the public knows that sometime in the near future the Fed is wanting to raise interest rates while the ECB is still struggling to decide what is their next move.

Comments are closed.