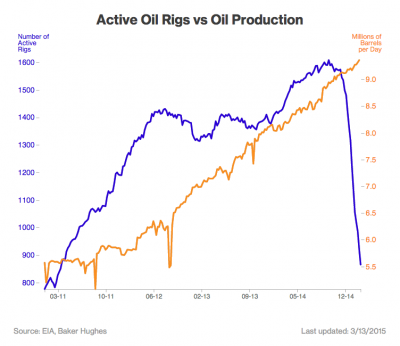

As Marybethand I posted, domestic oil production is becoming an important economic issue. In her post, Marybeth finds that the U.S production has been rising despite the huge decrease in global oil price. Domestic producers may be still cranking out oil so far, yet there are signs of slowdown everywhere. Bloomberg created an animation that shows the record drop in drilling activities. The declining oil price has caused domestic producers to shut down rigs at an unprecedented rate. Bloomberg estimates that about active rigs declined by more than 40 percent.

As you can see from the screen shot above, you can interact with the animation by clicking different state, rig type, and time period. I highly recommend everyone to check it out via link below.

So why is it that the production itself is actually increasing when drilling activities are falling? According to Bloomberg, the opposite trend in production and drilling is due to efficiency of new wells. These new wells pump oil faster and in larger quantity. Therefore, “despite the tumbling number of active rigs, the U.S. is pumping more oil than any time since 1972”. The graphs below depicts this relationship.

Source: http://www.bloomberg.com/graphics/2015-oil-rigs/

2 Comments

Neat graph!!

As per comments on previous posts, while it’s obvious in hindsight, it is really hard (at least if you’re not an energy economist!) to really believe in diminishing returns. The data however are clear: there were lots of marginal wells being drilled, which would be barely profitable, that is, not produce much petroleum. Clearly the distribution is wide, there are really, really good wells out there too.

It is really interesting to see the dramatic decline in the number of active oil rigs in the United States and see that production is still growing. I would not have expected the efficiency of the new wells to be so significant.

Comments are closed.