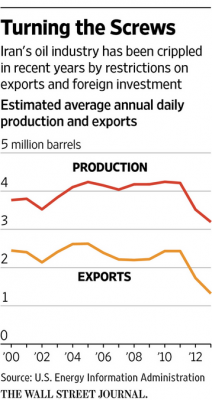

In recent years, Iranian oil exports have been severely hampered by U.S.-led sanctions. However, as part of Iranian nuclear negotiations, Iranian oil (500,000 barrels or more a day, according to some analysts) could once again reach the global market. These revelations come as crude oil prices are already under heavy pressure from a supply gut due to decreasing demand in Europe and China, down 59% from peak price in June 2014.

In recent years, Iranian oil exports have been severely hampered by U.S.-led sanctions. However, as part of Iranian nuclear negotiations, Iranian oil (500,000 barrels or more a day, according to some analysts) could once again reach the global market. These revelations come as crude oil prices are already under heavy pressure from a supply gut due to decreasing demand in Europe and China, down 59% from peak price in June 2014.

“In case the international sanctions against Iran are lifted, one million barrels a day will be added to the country’s crude-oil production and exports in several months,” said Iran’s Oil Minister Mr. Zanganeh. The Minister also said that Iranian oil influx wouldn’t “significantly affect crude-oil prices and world markets.”

http://www.wsj.com/articles/irans-nuclear-deal-could-open-oil-flood-1426524085

2 Comments

I wonder how this would affect the US shale companies. I believe they suffered when Saudi Arabia increased oil production to lower prices and undermine the US shale companies (because the US extraction techniques are more expensive).

What should the price of oil be, from a depletable resource perspective? Do we really want more oil now, or would it be good for us (and the US) if we leave it in the ground when prices are low???

Comments are closed.