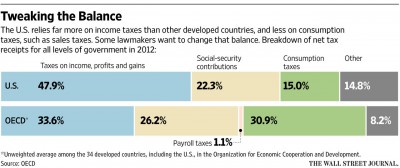

The tax-writing Senate Finance Committee is giving new consideration to consumption tax ideas in hopes to boost economic growth. Lawmakers argue that the consumption tax it getting a great deal more respect and discussion. They hope to create a type of consumption tax known as a value-added tax, and, at the same time, lower business taxes and scrap income taxes for lower-income Americans. Interviews suggest that both Democrats and Republicans are interested in working towards a more consumption based tax system. Consumption taxes hit the money people spend rather than the money they earn. Some economists argue that under the consumption based system, savings and investment are taxed lighter, which could encourage investment and innovation. The U.S. system already has certain features of a consumption based system, such as tax-advantaged retirement savings accounts and lower rates for investment incomes. New plans might include a European value added tax, which is a type of sales tax collected on each stage of production, traditional sales taxes, and taxes on carbon-based pollution. Although discussions are still in their early stages, what do you think of the shift to a more consumption based tax system?

Source: http://www.wsj.com/articles/tax-proposals-would-move-u-s-closer-to-global-norm-1427659773

6 Comments

I think it’s a really interesting concept, but I would have to read more about its implementation in other countries, as well as its effect on investment. I would just be worried that, on net, it could potentially end up as a tax increase on the lowest income earners.

Agree that the U.S. ought to tax firms at lower rate and tax higher incomes higher, but a VAT is essentially the same thing as a tax on income, which I agree with moorem15 is likely to hurt low -income earners disproportionately.

Sales taxation should be a state issue.

This concept appears very regressive. A consumption tax would likely encourage more saving, but this would benefit those with higher incomes significantly more than those with lower incomes.

I think in light of the current economic situation that we were just in it might not be the best idea to tax consumption right now. As we are still feeling the effects of the recession, I do not think it would be a great move on policy makers part to start taxing consumption.

A VAT is administratively easy to implement and collect, and hence can be perceived as fairer. Structuring it so that there are not big loopholes is important. Will renters pay VAT while homeowners, who effectively pay rent to themselves, pay nothing? Will food be taxed at a lower rate? So income taxes can in principle be fairer.

It’s not at all clear that corporate taxes in the US are high, because of the complexity of the system. There are issues of double taxation (dividends are paid out of profits, and both are taxed).

Moving from one system to another has to be done carefully. Not taxing capital (no corporate taxes!) would be a huge windfall to the wealthy, and a slap in the face (and hit in the wallet) to all those whose income depends on labor. It would be ironic if we in the US follow Marx in treating Capital as central….

Greater emphasis on consumption tax is interesting. It may help increase revenues that aren’t included in the income tax due to interaction in the black market. But it may affect lower segments of society more severely than the rich.

Comments are closed.