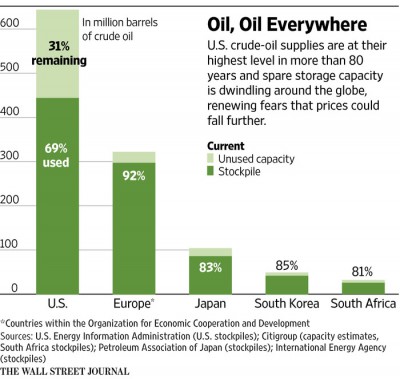

The latest oil conundrum revolves on where to put it. U.S. crude oil-supplies are at the highest level in more than 80 years, equal to almost 70% of our storage capacity. Likewise, Citigroup Inc. estimates that European commercial crude storage has reached approximately 90% capacity, and inventories in South Korea, South Africa, and Japan are almost at 80% capacity. Some analysts predict that already low oil prices could continue to fall, as producers sell oil at a discount to the handful of existing buyers that have room to store it.

Accordingly, production exists at nearly 1.5 million barrels a day more crude than the world needs, as a result of decreasing demand and rising production in the U.S. If this continues, many producers may be forced to shut their wells, and store oil below ground.

As a result, storage space is now becoming a tradable commodity. CME Group Inc., plans to launch the first oil-storage futures contract on March 29. This will allow traders and producers to buy and sell the right to store specific types of oil in Lafourche Parish, La., for a defined month.

http://www.wsj.com/articles/oil-glut-sparks-latest-dilemma-where-to-put-it-all-1425577673

4 Comments

I read an interesting article about how the brent-WTI spread will increase as the U.S. approaches their inventory capacity. However, once we reach capacity and become forced to export, there could be a major inversion between the pricing of the two varieties. I do wonder what the legal process will be if we need to export due to inventory issues. That said, hopes definitely seem high that summer will bring enough domestic demand to keep that from happening.

Are there any studies on what the impacts of natural resources storage space are on developing countries? Could poor countries with vast amount of sparsely populated areas benefit from this new business? At the same time, I wonder the long term environmental (and consequently, environmental) cost of artificially storing excess supply of oil.

Well, if there’s no place to store production, and it’s hard to ship (export) because of limited port capacity, then isn’t the only alternative to leave oil in the ground? That of course means no cash flow for producers, which would lead to a wave of bankruptcies across the various oil patches.

This recent press release makes an interesting claim. http://www.afpm.org/news-release.aspx?id=4737

Comments are closed.