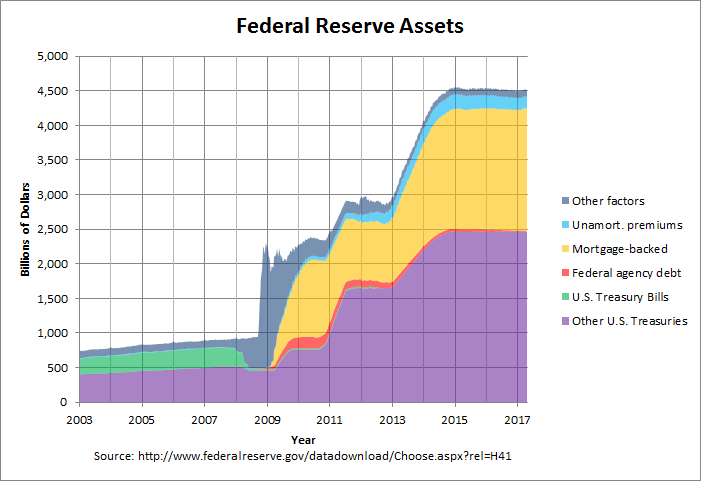

Over the past couple of years, the Fed’s aggressive monetary policy has led to a widely expanded balance sheet. With roughly $4.5trillion worth of assets on its books – predominantly treasuries and mortgage-backed securities – the Fed might appear far more exposed to risk than it might permit for US companies. At Janet Yellen’s recent Senate testimony, South Carolina Republican Sen. Tim Scott remarked, ” But it appears that nobody is stress-testing the Fed. The Proverbial Fox is guarding the hen house from my perspective.”

Over the past couple of years, the Fed’s aggressive monetary policy has led to a widely expanded balance sheet. With roughly $4.5trillion worth of assets on its books – predominantly treasuries and mortgage-backed securities – the Fed might appear far more exposed to risk than it might permit for US companies. At Janet Yellen’s recent Senate testimony, South Carolina Republican Sen. Tim Scott remarked, ” But it appears that nobody is stress-testing the Fed. The Proverbial Fox is guarding the hen house from my perspective.”

Yellen responded by saying that the Fed does in fact conduct stress tests on itself. However, as many of the graphs in the linked article demonstrate, the Fed appears to have far more risk than the banks it regulates. Yellen explained that the Fed’s powers and function give it more flexibility with its balance sheet. Yellen certainly has a point, yet this is the first time an experiment like this has been run. I really wonder what a net release of some assets would like. Of course, that is years or decades away, but it by no means seems like something that will go over smoothly.

http://blogs.wsj.com/economics/2015/02/24/the-feds-stress-tests-of-itself-arent-as-stressful-as-its-tests-of-banks/

2 Comments

This is one piece of a thinly veiled effort to exert political influence over the Fed; “auditing” the Fed is the rallying cry. Apparently legislators such as Tim Scott believe they understand monetary policy better than economists who’ve spent a lifetime on the issue. Some of course are recipients to The Truth as revealed in a few passages in a 60-year-old novel by Ayn Rand, such as Paul Ryan. In fact, the political independence of central banks has been a policy objective of economists of all stripes, though that effort has been spearheaded by conservatives such as Milton Friedman.

In this particular instance, the assumption is that the because the 12 regional Feds are called “banks” they in fact are banks. However, the Federal Reserve System has no need to ever sell its bonds or other financial assets, except on the margin when it wants to raise interest rates. The Fed doesn’t have depositors in the same sense as a regular bank. It also faces no credit risk. (The Treasury could default on its debt, but that would likely be because the US is going out of existence. For the Fed it might it hard to sell bonds to raise interest rates, but surely that would be the least of our worries!) Scott and others apparently aren’t aware that to date the Fed has made a profit on the assets it bought in late 2008 during the peak of the financial crisis. [Look for articles on the status of Maiden Lane I, Maiden Lane II and so on, the names of the investment vehicles the Fed set up.]

So: listen to Yellen. She’s honest and competent, and as an Senate-approved public servant doesn’t have to toady to one or another group to stay in office. It would be unfortunate if Congress were to take back the independence they’ve granted the Fed. It would be a tragedy if they took it back to hand over control to members who want to use the Fed as a tool in their reelection campaigns.

It is understandable that the Fed being exposed to much more risk than would be allowed to other US companies would initially raise some red flags. Of course, at the same time politicians overstepping their boundaries in trying to over manage the Fed is just as concerning. Just as both Yellen and Professor Smitka have mentioned the workings and capabilities of the Feb are vastly different as the “Fed’s liabilities are mainly reserves to the banking system and currency”. To look at the Fed and a regular bank in the exact same way minimizes the responsibilities of both.

Comments are closed.