By Joana Traykova & Clara Tran

The United States has been facing a significant budget deficit. At the end of fiscal year 2011, the enacted [no, realized! — revenues are endogenous] deficit was $1.327 trillion ($2.469 trillion total revenue minus $3.796 trillion total expenditures). The U.S. debt-ceiling crisis was ended with the Budget Control Act of 2011 which raised the debt limit and enforced deficit reduction by cutting government spending. At the beginning of 2013, tax will increase as the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act 2010 expires and the Budget Control Act 2011 goes into effect. This is called the fiscal cliff, i.e. simultaneous increase in T (tax as government revenue) and decrease in G (government spending).

The goal of the fiscal cliff is reduction of government debt [?deficit?]. In other words, if the government maintains the above actions, higher total federal revenues and lower federal spending will result in a roughly 50% deficit reduction. However, theory suggests a decrease in G entails a decrease in GDP (Y=C+G+I+X-M). Thus, research data projects that as G declines, growth will cut in half and the U.S. would likely fall into a recession. Furthermore, if unemployment is predicted to rises almost a full percentage point as predicted, which will constitute a loss of about two million jobs, the impact of decrease in G will be amplified. In addition, it would add to the deficit and increase the chance of default.

Businesses already cut spending (e.g. cancelling new investments and putting off new hires) and or planned to do so for fear of the fiscal cliff. That means, although the fiscal cliff has not yet happened, it is already affecting the economy and triggering unemployment.

In the context of these studies, we would like to examine the proposed budget plans of the two presidential candidates and how they will affect the economy.

Obama’s budget:

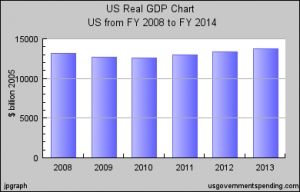

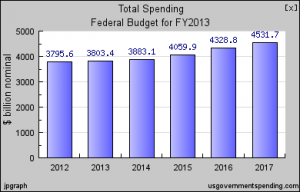

We examine the grand total of the planned government spending (G) for the period 2012-2017. The estimates for the total GDP come from http://www.usgovernmentdebt.us/fed_us_real_gdp_chart_09_k.html#usgs101 and are in billions of USD. For 2012, G=3, 795, which according to estimations is 28% of the total GDP; 2013, the total G=3803.1, which according to estimations is 27% of the total GDP; for 2014 G=3883.1; for 2015 G=4059.9; for 2016, G=4328.8; for 2017, G=1,174.4.

Romney’s budget:

According to Romney official Plan for Jobs and Economic growth,(http://www.mittromney.com/sites/default/files/shared/Fiscal.pdf) “as president, Mitt Romney will immediately move to cut spending and cap it at 20 % of total GDP. As spending comes under control, he will pursue further cuts that would allow caps to be set even lower so as to guarantee future fiscal stability.” In other words, Romney plans greater decrease the G in comparison to the current level, which Obama’s office maintained.

It is easy to see that Obama’s fiscal plan envisions a narrower fiscal cliff than Romney’s fiscal plan. In the context of the review literature on the impact of fiscal cliffs on the economy, Romney’s fiscal plan will be more detrimental to the U.S. economy and the labor market than the fiscal plan of his opponent.

However, it is important to note that a few recent articles argued that the fiscal cliff effect is not leading to current layoff.

The Washington Post on Sep. 24:

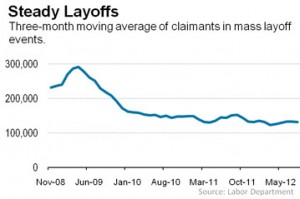

“So far, however, it’s hard to see in the data. Over at Real Time Economics, Ben Casselman passes along the following chart suggesting that we’re not yet seeing an uptick in mass layoffs. In fact, August saw slightly fewer mass layoffs, involving 50 or more workers, than July did:”

The Wall Street Journal on Sep. 21:

http://blogs.wsj.com/economics/2012/09/21/fiscal-cliff-not-leading-to-layoffs-yet/

“So far, though, there’s little sign of a surge in layoffs. August saw 1,267 mass layoffs — those of at least 50 workers — according to new data released Friday, down slightly from July. About 127,000 workers lost their jobs in such actions, 10,000 fewer than a month before. Mass layoffs were also down among manufacturers, the sector likely to be most directly affected by the fiscal cliff. […] Thus far, though, the data don’t show any reason to panic.”

We would like to hear your thoughts on the issue at hand.

4 Comments

To create a bullet list I inserted <ol> … </ol> around everything and <li> …. </li> for each item.

Some of my thoughts:

On the multiplier effect, my question is can Romney/Ryan find 8% of GDP in government spending to cut that will not multiply into anything more than 8%. Also are there programs that can be cut that would not significantly impact employment and cause mass layoffs? I am skeptical…

From today’s class, it is obvious that future expectations play an important role in businesses’ investment in capital. Would a budget deal that eliminates or narrows the fiscal cliff do anything to boost business’s expectations and calm uncertainty about the future outlook of the United States? With the 30 year treasury only yielding 2.86%, my sense is it would not.

We’ll be asking how “the” multiplier can be measured. But (i) in a recession and (ii) when you’re cutting jobs directly, then there’s no reason to think you won’t get a multiplier effect. Of course if you buy the “confidence game” stance of some on the right then somehow the size of the government is what is preventing people from getting jobs, so that not only will those fired land new positions, but so will others.

If long-term interest rates reflect expectations, then cutting the deficit would tend to lower them further, which would say businesses expect even less demand for funds down the road … of course if they believe there’s a multiplier component, then that too would lower expectations of a boom down the road. Of course the confidence game people must implicitly believe that businesses are currently turning away customers because they’re so uncertain of the future that they don’t want to expand. I’m sure all the seniors would like to know just what those firms / industries are, because that hints that sooner or later they’ll hire in droves.

I suspect that’s not the messages seniors are getting in their job searches.

Swing states will make the decisions. Who will win it? What is your opinion?

Comments are closed.