Chairman Bernanke delivered a speech on November 20th to the Economic Club of New York. The speech is titled “The Economic Recovery and Economic Policy” and a full transcript can be found here: http://www.reuters.com/article/2012/11/20/idUSW1E8KA00A20121120. I will summarize Charman Bernanke’s main points and analyze and critique a few of his comments. His speech focused on the main indicators of economic recovery and growth, and he also discussed the effects of the fiscal cliff.

Unemployment

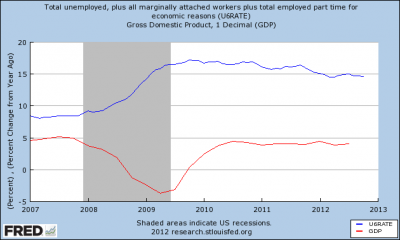

The unemployment rate is currently 7.9%, down from a peak of 10% in the fall of 2009. The improvement of the labor force has been slower than the FOMC expected, and remains significantly above the natural rate. Mr. Bernanke stated that most members of the FOMC believe the current unemployment rate is between 2% and 2.5% higher than the long-term natural rate. This puts the natural rate between 5.4% and 5.9%, which is a level that the economy has exceeded since mid 2008. While the improvements in the labor force are a good sign for the economy, there are significant concerns surrounding long term unemployment, part time employment, and a decrease in labor force participation. These concerns can been seen in the graph I inserted above, which shows unemployment and unemployment including underemployed workers and discouraged workers – U6 unemployment. The spread between the two series was about 3% before the recession, and has been about 7% since the recovery started in mid 2009. Chairman Bernanke stressed the concern of structural unemployment, where there is a mismatch between workers’ skills and available jobs. Additionally, high levels of long-term unemployment decreases workers’ skills and workers lose their attachment to the labor force, which makes it difficult to re-enter the workforce.

Inflation

Inflation has averaged 2% since the recovery started in 2009, which aligns with the long-term goal of the Fed. Fluctuations in crude from global political concerns have caused ups and downs in monthly inflation calculations. Additionally, the summer drought increased commodity prices which increased consumer food costs. However, the Fed is not concerned with long term inflation because there is room for much improvement in both labor and product markets. Until these markets return to pre-recession equilibrium levels, there will not be any reason for inflation expectations to change, and they will remain stable around or below the Fed’s 2% objective.

Housing Market

The anemic recovery of the housing market has been a major factor in the slow economic growth since the recession. Chairman Bernanke said the Fed has studied previous recessions, and recessions that involve housing bubbles usually take longer to recover. This is one of the main reasons the Fed has increased their purchase of mortgage backed securities, hoping to decrease interest rates for consumers looking to purchase or refinance their homes. Headwinds remain in the housing market, as housing prices have lost about a third of their value since 2006, leaving roughly 20% of mortgages underwater. While lower prices and interest rates should augment the housing market recovery, credit lenders have tightened the conditions for mortgages as they look to decrease risk amid uncertain economic and regulatory conditions.

Fiscal Cliff

Chairman Bernanke highlighted the needs to develop a sustainable long-term fiscal plan without hindering the short-term economic recovery. While the federal deficit has decreased to 7% of GDP from 10% of GDP in 2009, it remains above a sustainable level. Congressional Budget Office projections have the level above 4% in 2018, but also project the debt to GDP level as increasing. The only way to develop a sustainable economic future is to have debt to GDP levels constant or decreasing. The current uncertainty surrounding the fiscal cliff has led to decreased business and consumer investment, and the CBO projects the economy will dive into another recession if the spending cuts and tax increases are not resolved before we fall off the cliff.

Monetary Policy

Chairman Bernanke said “Monetary policy can do little to reverse the effects that the financial crisis may have had on the economy’s productive potential,” but the Fed’s tools have been successful in offsetting the headwinds to economic recovery. They decreased the Fed Funds Rate to 0% in 2008, and have also used quantitative easing to decrease interest rates. Bernanke touted the Fed’s transparency of continuing guidance about monetary policy through 2015, and how this has helped decrease uncertainty in the economy. In their September meeting, the FOMC decided to increase their purchase of MBS to aid the housing recovery, in addition to continuing Operation Twist to extend the maturities of their Treasury holdings and decrease long-term rates.

Critique

When Bernanke spoke about unemployment, he said that the economy must grow at a rate above its long-term trend in order to decrease unemployment. Trying to explain the weak labor market recovery, he said: “So the fact that unemployment has declined in recent years despite economic growth at about 2 percent suggests that the growth rate of potential output must have recently been lower than the roughly 2-1/2 percent rate that appeared to be in place before the crisis.” While the unemployment rate has decreased from the height of the recession, the economy has not grown enough to significantly decrease the U6 rate, which is a much better indicator of the health of the labor market. I agree with Chairman Bernanke that the growth rate of potential output is actual lower than it was before the crisis, as productivity gains are lower than pre-crisis because investment in human and physical capital has decreased. However, I do not think it is fair to say our 2% growth has been enough to decrease employment, because the U6 rate is a better indicator and it has only marginally improved since the crisis. The graph below shows GDP growth and the U6 rate. U6 increased as GDP growth decreased during the recession, but the U6 rate has not decreased significantly as GDP growth recovered and leveled off around 2%. Policy makers and financial markets pay more attention to the overall unemployment rate instead of the U6 rate, but it is obvious that the economy would be having a more robust recovery if the U6 rate would decline. A question that would be useful in analyzing the U6 rate is what portion of underemployed workers are in that situation because employers want to keep them as part time workers so they do not have to offer benefits. While this may be a small portion, the compounding effects of the uncertainties from Obamacare, Dodd-Frank, and the fiscal cliff contribute significantly to the U6 rate.

While not a critique of Charman Bernanke, it is also worth noting that the Fed has utilized all monetary policy tools, and they recognize there is little they could do to help the economy if we fall of the fiscal cliff. Equities markets have had technical support the past few years that market analysts have dubbed the “Bernanke Put.” Put options are used as protection against declines in the market, and the “Bernanke Put” has existed because investors believe the FOMC will continue to use their monetary tools whenever there is a decline in the economy. Regardless of any fundamental weakness in equities, the “Bernanke Put” has created a price floor for stocks. In today’s speech, Bernanke said there are no monetary tools strong enough to counter the economic downfall from falling off the fiscal cliff. While the Fed has useful and powerful tools for creating accommodative economic conditions, it is imperative that Washington solves the fiscal issues before the end of the year. Otherwise, as the CBO and many others project, the U.S. economy will fall into another recession, and there is no more room for Fed stimulus and no additional monetary tools the FOMC can utilize.

2 Comments

The Fed has been constrained to some degree by the zero lower bound on interest rates since they reduced the fed funds rate to zero. In this sense, there is little more that the Fed can do in regards to traditional monetary policy. In response, Bernanke has relied heavily on non-traditional monetary policy (such as the FOMC’s purchases of MBS) but diminishing returns on these sort of activities may call into question their effectiveness as they are continued. As a result The fiscal cliff will present a serious problem for the Fed if not avoided. They have very few, if any, cards to play if the economy falls back into recession.

Comments are closed.