…sequestrian offers a “natural” experiment to test views of government… Microeconomists will thank Congress for providing a natural experiment to test competing views of government.…

Month: February 2013

In my Development Economics class we spent extensive amount of time researching and reading about why developing nations are not narrowing the gap (in terms of technology) between themselves and developed nations. It would seem that developed nations are closer to the metaphorical “ceiling.” In contrast, developing nations have much room to grow, thus they should grow faster. This narrowing of the gap is referred to as “convergence.” Knowledge spillover would seem to benefit developing nations, these countries do not have to invest in R&D and should be able to piggyback off the research and breakthroughs of developed nations, without all the headaches.

In practice, studies do not show convergence, studies in fact show divergence. In other words the overall technological gap between developing nations and developed nations is widening.

The creation of the E.U. countries such as Greece, Portugal, Italy, Ireland and Spain gained the ability to borrow money at all time low. As a result, this fiscally irresponsible countries have absurdly high levels of debt (see Chart 1). Due to the financial meltdown of 2008, these countries became highly insolvent, the costs of borrowing skyrocketed (above 10% for most of P.I.I.G.S.) and economic activity slowed down dramatically therefore, unemployment skyrocketed (see Chart 2). Despite that the E.C.B utilized most of its monetary power to increase confidence in the area, fiscal irresponsibility that these countries took is now an issue that not only the E.U. should be concerned about it but the United States too.

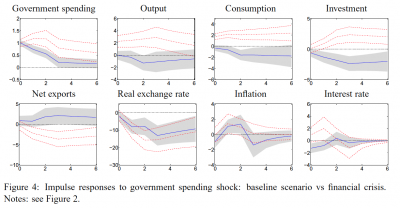

Corsetti et al (2012) use a “Taylor Rule” approach to estimate normal (endogenous) fiscal policy, and then use the error in the fitted values as a measure of “true” fiscal policy that would not be automatically included in the variables of a typical VAR. They then use this to test the size of the multiplier, using a panel of countries to include ones with pegged vs floating exchange rates, with high debt levels, and in a financial crisis.

Corsetti et al (2012) use a “Taylor Rule” approach to estimate normal (endogenous) fiscal policy, and then use the error in the fitted values as a measure of “true” fiscal policy that would not be automatically included in the variables of a typical VAR. They then use this to test the size of the multiplier, using a panel of countries to include ones with pegged vs floating exchange rates, with high debt levels, and in a financial crisis.

According to the most recent news release from the Bureau of Economic Analysis, Real GDP decreased 0.1% in the fourth quarter of 2012, but increased 2.2% for the full year after increasing 1.8% in 2011. The pickup in economic growth for the full year 2012 mainly reflected a slowdown in imports, notably in capital goods (except autos) and consumer goods, a rebound in residential housing, an upturn in inventory investment and a smaller decrease in state and local government spending. The news release ascribes the acceleration in real GDP in 2012 to “a deceleration in imports, upturns in residential fixed investment and in private inventory investment, and smaller decreases in state and local government spending and in federal government spending that were partly offset by decelerations in PCE, exports, and non-residential fixed investment.”

The Labor Department recently reported a disappointing US worker productivity contraction of an annual percent of 2 percent in the fourth quarter of 2012. In the same timeframe, the economy declined at an annual rate of .1 percent, potentially attributed to defense cuts and slower restocking. The departure from positive numbers in the third quarter may also be due to expectations of the potential implications of the sustained fiscal cliff issue. Some economists are not surprised with the weak trend in productivity from the last two years as they see it as part of the cycle of recovery from a recession. For a period immediately after a recession, productivity will appear to rise because a smaller labor force must meet increasing demand. As demand rises, companies must hire more workers if they want to compete in the marketplace. (The full article.)

Seasonally adjusted vs non-adjusted data: graphs say it all.

Recently, there have been mixed opinions about the state of the housing market. While one could argue that now is a good time to buy real estate, this statement mostly assumes that things won’t get worse, and they certainly could. Many experts believe 2013 will be a good year to be a seller because there are fewer homes on the market, propping up prices, and mortgages are more easily available.

Recently, there have been mixed opinions about the state of the housing market. While one could argue that now is a good time to buy real estate, this statement mostly assumes that things won’t get worse, and they certainly could. Many experts believe 2013 will be a good year to be a seller because there are fewer homes on the market, propping up prices, and mortgages are more easily available.

Click the title for a post “the” multiplier from Jared Bernstein