Corsetti et al (2012) use a “Taylor Rule” approach to estimate normal (endogenous) fiscal policy, and then use the error in the fitted values as a measure of “true” fiscal policy that would not be automatically included in the variables of a typical VAR. They then use this to test the size of the multiplier, using a panel of countries to include ones with pegged vs floating exchange rates, with high debt levels, and in a financial crisis.

Corsetti et al (2012) use a “Taylor Rule” approach to estimate normal (endogenous) fiscal policy, and then use the error in the fitted values as a measure of “true” fiscal policy that would not be automatically included in the variables of a typical VAR. They then use this to test the size of the multiplier, using a panel of countries to include ones with pegged vs floating exchange rates, with high debt levels, and in a financial crisis.

The multiplier in their baseline scenario is typical: positive but less than one with no consumption response (their Figure 1 of the relevant full-sample impulse functions). However, their exchange rate impulse function shows big swings, even though their sample includes Euro zone countries where major trade partners use the same currency. That suggests controlling for exchange rate regimes matters. In theory (Mundell-Fleming) a flexible exchange rate country will see swings therein offset fisal stimulus; if the economy is operating near capacity, then investment could be crowded out (and net trade). When they look at a normal, non-recessionary country that’s what they find.

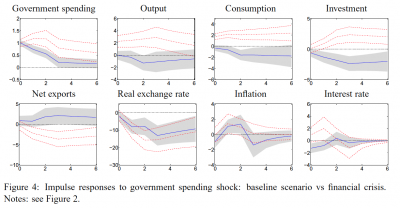

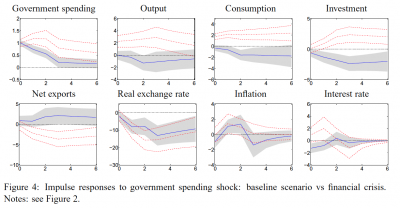

In contrast, for countries facing a financial crisis (checked against other definitions, Figures 5-7) they get results such as in Figure 4 above. The blue & gray are their baseline scenario; the dotted red are the central trend and confidence interval for countries in crisis – the relevant case for the US today. Output, consumption, and investment all respond positively, with the confidence interval now not only positive but lying above the confidence interval of their baseline scenario. Inflation (the 3rd box lower row) looks positive, but the confidence interval includs the 0 axis, so is little different from the baseline. The one puzzle is the negative impact on net exports, contrary to what we see in the US, perhaps because their crisis sample is too small to separate countries with fixed versus flexible exchange rates. They don’t calculate the area under their curves (“the” multiplier) and only note that:

In fact, the recent policy debate in the United States has featured repeated claims that fiscal multipliers could be as large as two under current conditions. Our estimates are consistent with a multiplier of this magnitude, even though our results for “normal times” do not suggest large fiscal multipliers at all.

This paper still cannot avoid small sample sizes; the number of financial crises (thankfully) is not large, and they attach explicit caveats. Still, it is an interesting way to address the endogeneity issue, while the use of a set of countries (we will not address the attendant econometric issues!) allows attention to seldom-occuring events.

Corsetti, Giancarlo , Meier, Andre and Müller, Gernot J. (2012). “What Determines Government Spending Multipliers?” International Monetary Fund. June, WP/12/150.