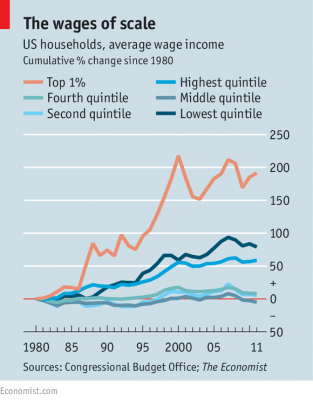

This The Economist article invokes Thomas Piketty’s “Capital in the Twenty-First Century the issue of income inequality in developed nations is not a uniquely American problem and may have more to do with the structure, prevalence and pay schemes of large corporations than simply a not too steep progressive system of taxation. Piketty makes the point that in America and Britain, the countries’ largest firms have grown in number of workers by about 50%. And while the expected dynamic of pay would be that workers at larger firms get paid proportionally more than workers at smaller firms; the case is that lower-end workers get paid not significantly more than those workers at smaller firms, while top brass get paid much, much more. Piketty’s proposal is that a solution for income inequality is not to redistribute wealth out of the hands of large corporation’s high earners, but to increase completion and thereby stifle the rapidly growing corporations.

This The Economist article invokes Thomas Piketty’s “Capital in the Twenty-First Century the issue of income inequality in developed nations is not a uniquely American problem and may have more to do with the structure, prevalence and pay schemes of large corporations than simply a not too steep progressive system of taxation. Piketty makes the point that in America and Britain, the countries’ largest firms have grown in number of workers by about 50%. And while the expected dynamic of pay would be that workers at larger firms get paid proportionally more than workers at smaller firms; the case is that lower-end workers get paid not significantly more than those workers at smaller firms, while top brass get paid much, much more. Piketty’s proposal is that a solution for income inequality is not to redistribute wealth out of the hands of large corporation’s high earners, but to increase completion and thereby stifle the rapidly growing corporations.

Source: The bigger, the less fair

4 Comments

Can technology be to blame? In a more technological geared world some say that increasing inequality is due to the demand for more skilled workers. The working paper mentioned in The Economist article “Wage inequality and firm growth” suggests that the rising size of the average firm is a strong contributor to the rising inequality in the United States and around the world. Just in terms of a simple economies of scale model it makes sense that a larger firm is more productive, up to a certain point. Why can’t they pay their workers more? Stifling of rapid growth seems slightly counter intuitive.

Well, what is the “payout” by large firms to employees? shareholders? Liz is correct that answering these sorts of questions requires correctly diagnosing causes, and not just noting loose correlations. In any case, “more competition” is easy to request but hard to accomplish, and (as those who took Econ 243 should realize) the link between the number of firms and the “competitiveness” of markets is tenuous. If size is due to efficiency (again, as per Liz above) then forcing more competition may do more harm than good. In addition, what of “standard” wars? do we really benefit from having multiple search engines, or does that entail much duplication = higher costs?

In any case, in the short run the real issue is low levels of employment. Until that shifts, income inequality may be a symptom of a more serious disease, a lack of jobs of any sort.

Does this article take into account the quality of goods that are produced? Meaning that in general, larger companies pay only slightly more than smaller ones, but if they produced the same good, would this change? When looking at this closer level, do companies begin to pay wages commensurate to the market power they exhibit?

Rather, to change Keifer’s phrasing, do firms share earnings with workers, or solely with managers and (through fees for financial games) Wall Street? Isn’t the relative payouts to labor and capital the core of Piketty (whom I’ve not read)?

Comments are closed.