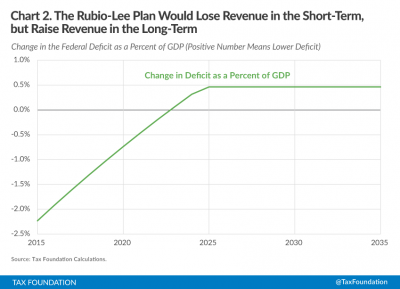

When it comes to our economy there are clearly different ways that economists look at it. Think tanks put out reports regularly that are often bashed by economists with differing viewpoints. Currently a tax reform that is under debate is the Rubio-Lee plan. One critic so gently put it, the “Puppies and Rainbows Tax Plan”. The goal of this tax cut plan is to generate revenue through three vantage points. The first is big tax credits for middle-income families with children. The second is corporate tax cuts. The third calls for the complete elimination of the capital gains tax. The Tax Foundation put out a report advocating for the Rubio-Lee Tax Reform Plan. Their claim is that the the plan would increase GDP by 15% and increase wages by 13% within the next ten years.

When it comes to our economy there are clearly different ways that economists look at it. Think tanks put out reports regularly that are often bashed by economists with differing viewpoints. Currently a tax reform that is under debate is the Rubio-Lee plan. One critic so gently put it, the “Puppies and Rainbows Tax Plan”. The goal of this tax cut plan is to generate revenue through three vantage points. The first is big tax credits for middle-income families with children. The second is corporate tax cuts. The third calls for the complete elimination of the capital gains tax. The Tax Foundation put out a report advocating for the Rubio-Lee Tax Reform Plan. Their claim is that the the plan would increase GDP by 15% and increase wages by 13% within the next ten years.

The main criticism of this report is that, while the general economics may be correct in theory, the model is just not applicable to such a complex economy that is the United States. Looking at it in terms of macroeconomic models this tax cut, some claim, works in theory in a “very small, very open” economy. Two things that the United States is not. Two different economists suggest, as more a jab than an actual suggestion, maybe trying this plan in the Netherlands Antilles or Bermuda.

This controversy as well as controversies over basically any other tax reform shines a light on the idea that studies can be diverted in order to get the result intended. In the case of the Rubio-Lee reform, a costly plan, the idea is that the tax reform will, eventually, pay for itself. However, the issue with this is the dynamic tax scoring rule that the House starting using in January that “gives legislation credit for its likely macroeconomic effects, including any rise in tax receipts due to economic growth”. This may give too much power to Think Tanks with skewed economic reasoning.

6 Comments

Our tax system is incredibly complex, and I like the idea of shrinking the number of tax brackets from seven to two for more simplicity. However, I do think that 35% for the higher bracket might be too high. Currently, if your income is between $38,000 – $91,000, you will be taxed at a marginal rate of 28%, whereas with the new plan, income over $75,000 will be taxed at a marginal rate of 35%. One other aspect that I do like is the elimination of the double-taxation system. I think this could potentially provide greater incentives to save and invest, thus improving economic growth.

http://www.rubio.senate.gov/public/index.cfm/files/serve/?File_id=2d839ff1-f995-427a-86e9-267365609942

While government spending is so high, it is probably wise to increase taxes to compensate. America is comparatively not the powerhouse it was in the 60’s but was able to grow strongly nonetheless. Low earners need not be taxed so much when they can save so little. The bottom 1/5 of American workers save less than 1% of their income while the top 1/5 save over 50% Why not increase the top tax bracket.

Sources: http://www.theatlantic.com/video/archive/2013/08/are-the-rich-getting-too-much-of-the-economic-pie/278807/

http://www.businessinsider.com/history-of-tax-rates

Please be careful when discussing taxes, as the claimed rates are often quite different in practice due to (as noted!) the complexity of the system. Someone for example whose income consists of capital gains might pay very little — not a marginal rate of 35%! Those at low income levels pay the maximum marginal social security tax rate, those with high incomes pay a marginal rate of 0% — another complexity.

But the claim in the comments that “government spending is so high” needs empirical backing. When I look at the data, what I see is a record low level (for example, the number of Federal employees as a share of the labor force).

Now can (do) taxes redistribute income? In the US, don’t those who are better off are more likely to use government services or things with a strong subsidy (infrastructure, higher education)? So which income decile pays what share of taxes?

I should add that the “dynamic scoring” claim is a barefaced attempt to justify tax cuts by claiming they don’t cut revenue. The empirical case for that is exactly zero. What proponents do is note that if you wait long enough, then tax receipts rise. But that’s due to general economic growth, and that receipts eventually rise passes over how much debt rises or whether total taxes to GDP rise — with a tax cut, clearly not. So if we’re worried about debt sustainability, dynamic scoring seems to suggest we can waive our hands, cut taxes, and — poof! — our debt declines into insignificance. Bullshit. Worse — bullshit isn’t likely fatal, just distasteful, herbivores aren’t spewing out pathogens fatal to us. Dynamic scoring however could have really, really bad consequences for the future of the US economy.

OK, what they’re proposing is to cut taxes from … 35% to .. ?? .. 17.5% for income taxes? That’s a 50% cut, and we’d need a 50% increase in GDP to end up revenue-neutral, not the 15% boost the article says proponents claim!! I bet these same proponents were against the ARRA because “fiscal policy doesn’t work” but now that it’s their proposal, they want to claim large multipliers!

Has this plan been executed in other countries? What is it based on — the article points out that it may be more suitable for significantly smaller and more open economies — but that the U.S. does not meet either of these criteria. These plans should be run on a smaller scale before implemented throughout the entire country’s economy.

There are of course large numbers of examples of tax cuts that can be used to analyze the “dynamic net gain” argument. The arithmetic that a 10% cut requires a 10% permanent increase in GDP relative to base (potential) GDP growth can’t be avoided via wishful thinking. While fiscal policy may be able to soak up excess capacity and return an economy to the long-run growth path, it doesn’t raise productivity growth. Wishful thinking turned into policy becomes delusional thinking!

Comments are closed.