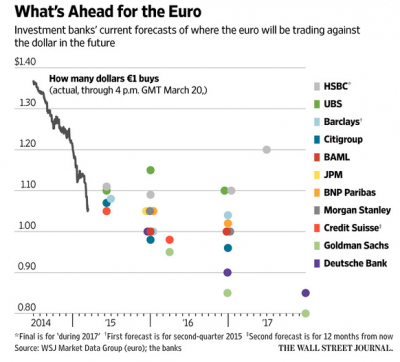

Different arguments regarding the future of the euro currently exist. Goldman Sachs’ analysts believe that the euro will be at $0.80 by the end of 2017, losing a quarter of its value from its current value. At the other end of the spectrum, HSBC’s economist believe that the euro will appreciate to around 15% to $1.20 over the same period.

The Goldman Sachs view is based on expectations that U.S monetary policy will begin to normalize, in that the Fed will raise interest rates from current near-zero levels. While this occurs, the ECB will still be aggressively performing open market operations, thus keeping interest rates low, resulting in investors shifting cash out of Eurozone assets. Additionally, the Goldman analysts believe the dollar is currently “underpositioned”, because financial markets move faster than the real economy, causing currencies to fall below their fair value until assets priced in that currency show compelling value.

HSBC’s analysts argue that as a result of its recent surge, the dollar is now one of the world’s most overvalued currencies, second to the Swiss franc. The rising dollar has put downward pressure on commodity prices, pushing U.S. inflation down as well. As a result, the Fed policy will likely remain accommodative for longer than the consensus predicts. Thus, what is bearish for the dollar will be bullish for the euro.

Who do you all think has the most sound argument?

http://blogs.wsj.com/moneybeat/2015/03/20/the-euros-going-down-if-it-doesnt-go-up/?mod=WSJBlog&mod=MarketsMain

4 Comments

There is a basis for both the claims of Goldman and HSBC. I might lean toward HSBC, however, the dollar is likely overvalued due to the massive amounts of QE that has not lead to significant inflation see this chart from the Cleveland Fed

https://clevelandfed.org/en/Our%20Research/Indicators%20and%20Data/Credit%20Easing.aspx

With such a large range let’s hope there aren’t actually many players punting on the dollar. If HSBC and Goldman actually follow trading policies in accord with their internal forecasts, one of them will be shutting its doors because they will be so deep in the red on their trades.

Ceteris paribus, shouldn’t QE however cause the dollar to depreciate, not become overvalued?

If America serves as any case study, the EU might be in line for a couple more years of loose monetary policy – whereas the US is already winding down. Once we see greater policy divergence over the next year, the Euro seems poised to fall against the dollar. That said – deflationary forces over their might lend it some support.

Rereading this, I’ve seen models of the real-nominal differentiation in reaction speeds. Expectations models also lead to overshooting. But can we define an equilibrium exchange rate? One that balances trade?

Comments are closed.