We have discussed the impact of aging population quite often now. The elderly depends heavily on savings for their expenditure especially after retirement. However, having already attained important assets such as housing and car, older people tend to spend less money than younger population does. In most developed countries, the proportion of older people has been expanding. This trend will seriously undermine these nations’ aggregate demand. South Korea is one of the countries currently experiencing this impact. The graph below shows the rapidly aging South Korean population.

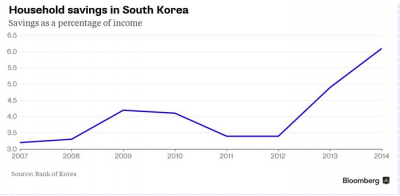

The Bank of Korea (BOK) has cut the interest rate three times since August 2014.Right now, the rate stands at an unprecedented 1.75 percent. However, there are few signs of strength in consumption. On the contrary, the household savings rate rose to the highest level in ten years in 2014.

Economists believe that the record-low rates have not been effective in encouraging consumption because they have failed to encourage the elderly to borrow and spend or invest. The BOK governor Lee Ju Yeol acknowledges that Korea’s aging population has altered how monetary policy affects the economy. For South Korea, the biggest hurdle to economic recovery may be weak domestic demand with growing elderly population who are reluctant to spend their savings.

Source: http://www.bloomberg.com/news/articles/2015-04-06/retirees-who-cherish-savings-have-south-korea-in-a-bind

3 Comments

In the US, we hear all the time on the news about the aging baby boom generation. I never would have considered the impact of an aging population’s changes in consumption, but it does make sense. i wonder if there exists a difference in propensity to consume between the retired populations of Korea and the US and how this might impact future aggregate demand.

While discretionary spending by the elderly falls, healthcare expenditures generally rise. In most countries — the US is the outlier — the end result is little net change (in the US it’s a big net increase).

But there is also a demographic effect, as there are more old people, who are no longer accumulating assets (and on average are selling them), and fewer younger people in the peak of their savings years. At the macroeconomic level this then tends to boost demand relative to the size of the economy, though fewer young people (fewer schools etc) can offset that.

In general, those retired have low income. So changes in household savings are more likely due to those working, particularly those in peak earning-cum-saving years. In general there are several sources for data that are collected in different ways and in practice are not comparable. The Household Income & Expenditure Survey lets you look at income, consumption and savings by age bracket. I added the link…

Comments are closed.