We have been discussing the global oil price and dollar appreciation. To continue the trend, I want to present an interesting article from Bloomberg that analyzes the impact of falling oil price and stronger greenback on Ecuador’s economy.

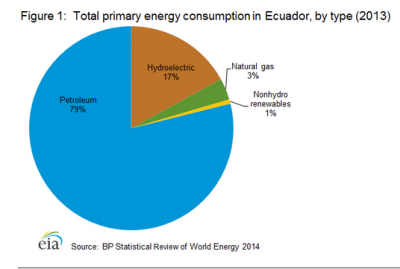

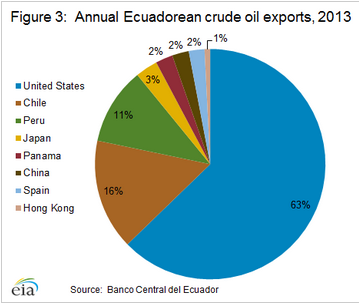

Ecuador is the seventh largest economy in South America. According to EIA, its oil sector accounts for more than half of the country’s export earnings and approximately two-fifths of public sector revenues. Accordingly, current decrease in oil price has negatively affected its economy as the country’s rate of growth slowed for a third year in 2014. Whereas the government predicted 4 percent growth rate, GDP only rose 3.8 percent in 2014 from a year earlier.

Ecuador also uses U.S dollar as its official currency. As dollar appreciates, its domestic goods became relatively more expensive, making its other exports more expensive. Meanwhile, maintenance on Ecuador’s biggest oil refinery has cut cut local fuel output by 48 percent since July last year due to declining profit from oil export. This necessitated the government to spend more on subsidized imports to meet demand. This imbalance in export and import has caused CA deficit.

Fortunately, growth in non-oil industries have been strong. During his weekly speech to the nation, President Rafael Correa stated that agriculture, shrimp farming and electrical output, helped underpin growth. However, even this gain gets offset by the falling crude oil prices.

4 Comments

When I think of falling crude price hurting oil exporting countries, I usually think of Russia, Iran, Saudi Arabia- not Ecuador or other South American countries. It’s also interesting to see in this case an oil exporting country that also uses the US dollar, and is therefore hit not only by the fall in crude but the appreciation of the green back.

Did the paper mention any long-term negative consequences for Ecuador that economists are predicting?

The article mixes two topics: resource dependency and dollarization. The latter is window dressing, is it not? — the oil boom allowed real wages to rise more than otherwise, reinforcing the centrality of oil by making it hard to export anything, or to compete with imports. So when oil does fall, they’re up the creek and their one and only paddle is broken.

I always wonder what role oil might have in determining the level of the dollar. US production has certainly accounted for a major reduction of our trade deficit, but could shifts in demand for oil itself affect the price of the dollar?

Comments are closed.