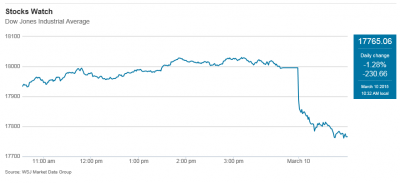

The U.S stock market experienced a large-scale decline on Tuesday, with the Dow falling 172 points (1%) to 17823. Likewise, the S&P 500 fell 21 points (1%) to 2059, and the Nasdaq fell 51 points (1%) to 4891. These declines have wiped out all gains for the year.

Analysts claim that there was no U.S. specific trading news that triggered the decline, but instead it was action in European markets. The dollar recently rose to a near 12-year high versus the euro (to $1.0787). Likewise, bond yields in the Eurozone hit lows, as the ECB began it’s quantitative easing program in order to drive up inflation.

Similarly, after a strong February jobs report, there has been talk that the U.S Federal Reserve is expected to begin tightening their policies this year, potentially raising interest rates as early as June. However, the Fed considers both employment and inflation when making monetary policy decisions, and because inflation still remains below the 2% target, this is highly debatable.

Additionally, moving Apple into the Dow, and AT&T out, is expected to cause the Dow to become more volatile, as the Dow is a price-weighted index, and Apple has a higher share price than AT&T.

http://www.dailyfinance.com/2015/03/06/market-wrap-stocks-decline-fears-rising-interest-rates/

http://www.bloomberg.com/news/articles/2015-03-10/u-s-index-futures-slip-as-fed-s-fisher-says-rates-should-rise

http://www.wsj.com/articles/u-s-stock-futures-drop-sharply-1425989837?mod=WSJ_hp_LEFTTopStories

3 Comments

I understand that uncertainty in the exchange market would cause the stock market to drop, but what I find interesting is that the Euro is falling back to its original exchange rate with the dollar for the first time in about a decade. I wonder how the continued quantitive easing by the ECB will continue to affect this exchange rate moving forward.

I wonder if the Fed has the authority to step into currency markets to temper the recent dramatic rise of the dollar. That said, I also wonder if that is a desirable policy. The strong dollar might be bad for US profits in the short run – but perhaps it will give the rest of the world’s exports a little extra steam.

Does the Fed have tools to directly affect exchange rates? — likely not, I’m not sure they legally can buy billions in Euro bonds, and they certainly would have a hard time justifying such a policy. The track record of such interventions (Japan at several points in the past 40 years) is not very good, a few days of purchases have only a few days effect. So the Fed would have to engage in a version of Quantitative Easing in which they buy Euro (and Yen) bonds in large quantities month after month.

Two issues. If expectations matter, then forex rates should move only on “news” – announcements that market participants did not anticipate. Second, if Europeans are buying US assets, in anticipation of QE on their end and higher interest rates on the US end, won’t this boost stock prices? Now for companies traded in the US that have most of their operations in non-dollar markets, then a billion euros of profits are suddenly worth fewer dollars, so perhaps a lower stock price is appropriate? Or is this just a noisy day in markets that follow a random walk, which thus has no particular significance?

Comments are closed.