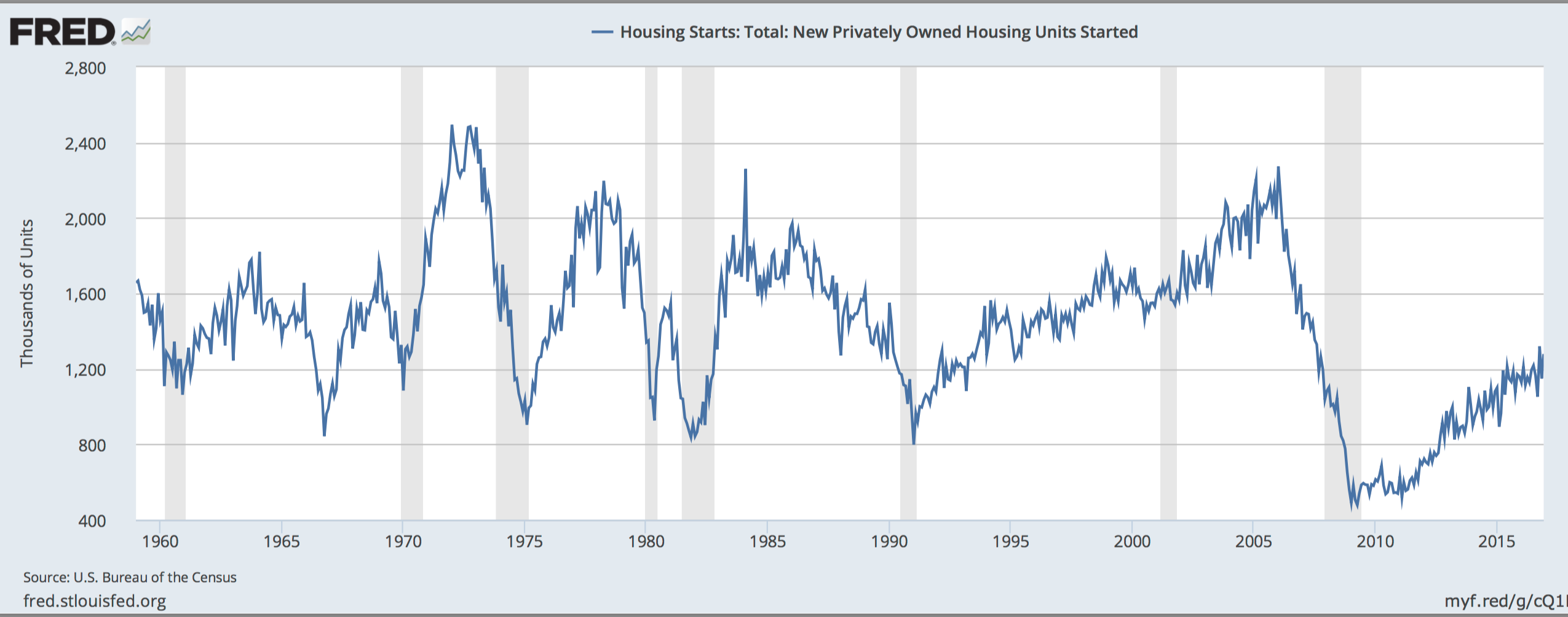

Housing starts have historically indicated a strong real estate market, which indicates a strong economy. As you see from the FRED graph, the 2008 crash brought the US to almost 1/6th of the US’s peak in housing starts. We are still recovering in 2017, but gradually. January 2017 housing starts exceeded forecasts, and analysts are expecting a 3% growth in February 2017.

It is unlikely that the US will experience a development boom like one from the 70’s or 80’s. Increased government regulation along with more cautious investment capital will make any serious development speedup unlikely. Since 2015, America has been tiptoeing around 1.2 million new units a year after steady growth from 2010-2015.

Economic policy (low rates) is probably helping the gradual growth, but the #1 cause of growth is the labor market. Job growth leads to housing start growth. Some are speculating that recent changes in the political environment may have a positive effect on housing starts due to new jobs along with jobs coming back to America. Also, if the Federal Reserve increases interest rates, like they have been planning on doing, it is likely going to negatively affect development.

Another interesting feature of the graph is the lack of any serious drop after the 2000 Dot-com bubble popped. That recession barely had an effect on the housing market while the 2008 subprime mortgage crisis is still affecting real estate growth nine years later. It could be that America is stagnating and will experience a similar European style economic slowdown. Hopefully not, though.

Graph posted by the Prof

Note that within FRED you can Edit a graph; one of the options is to add a series so that you can (as I did) divide the first one by it using the formula field (eg, a/b).

7 Comments

I think it’s interesting that you point out the relationship between housing starts and job growth. With unemployment rates at or near the lowest level in a decade, and at long run equilibrium levels, I wonder whether or not we can truly expect significant job growth, even with Trump’s promise to bring jobs back to the US. It seems to me that runway left for employment growth might be smaller than many politicians would have us to believe, and correspondingly, might mean slower housing start growth than expected.

Is it possible that housing starts will not pick up until we’ve seen long-term stability in home prices? Coming from the Minneapolis area, suburban residential development was skyrocketing before the recession, as families with cheap credit wanted access to better public schools. Twelve years ago my home was surrounded by farms. Recently, infrastructure projects for downtown Light Rail trains were approved linking, our neighborhoods to downtown commercial centers. The residential areas surrounding my neighborhood are now rows and rows of model homes, reflecting the preference for urban renting following the recession. It’s hard for me to believe anyone would begin building an hour from downtown before these homes are filled. Why would you build during a supply glut?

Interesting issues. If we look at housing starts relative to population [a FRED graph that I saved a year or two ago….and which gets automatically updated….register as a user!], then there’s an obvious long-run decline, as well as big swings.

The US is however a big place. Minneapolis does not look like Milwaukee, even though the underlying economies, population composition and so on were once almost identical. And then there’s Las Vegas. At the opposite end is San Francisco, where mountains and oceans limit buildable space. You can find nice work that compares “open” cities (Atlanta) with “closed” cities (SF) in housing prices, sprawl and other characteristics.

Oh, I posted the per capita graph at the bottom of the post.

@lancer17 While it would make sense for housing starts to follow long term stability in home values, that’s not what happens in reality. Basically, if a developer thinks a market is getting hot, they will build. They mostly do not care about long term as most real estate investment strategies have a 2-10 year timeline. That is the main reason that real estate is so cyclical. It’s hot so they add volume to the development pipeline, then before anyone knows it, supply has exceeded demand and the market contracts.

I think the geography of housing starts is important to consider as the job landscape and preferences of workers change in the coming years. Job growth is happening at a much faster pace in agglomerating cities such as Seattle, but is more stagnant in many smaller towns. Additionally, the millennial generation tends to favor big cities, and is more likely to be willing to move away from home. Therefore, as millennials join the job market, we should expect higher demand for housing, and thus higher prices, in bigger cities (with very little demand for new housing in small towns with little job growth). Thus, housing starts will be highly variable across states and the country, with most concentrated in big cities where home prices are higher. It’s possible this leads to greater sprawl in cities such as Atlanta.

Aren’t housing prices still low in most places? With lots of unsold houses? Why build a new one if an existing house is cheaper?

Ditto population growth: is the big trend “downsizing” with houses being sold and condos and nursing home slots being bought? After all, you’re not likely to have enough money to buy a house until you’re into your 30s, or a desire to do so. If the above is the case, then we may be observing changes in average prices but the real driver is a shift in demand for certain classes of dwellings that drives up the price of one type without causing the other to drop. Of course we may be seeing millennials buying houses from downsizing boomers who move into the apartments the millennials just vacated. No net impact on supply/demand!

To go off of some points already discussed, I think it would be interesting to examine the degree to which multifamily development has replaced housing development. Do we know for sure that renting is popular only because it is cheaper? I know it has traditionally been viewed this way, but is increased multifamily development in the place of housing necessarily bad? If, hypothetically, economists could identify a trend of growth in multifamily developments instead of housing starts as the result in preferences (perhaps a revived desire to live in an urban environment), does that matter to an economist? Is there any other information we can/need to consider in this scenario?

Comments are closed.